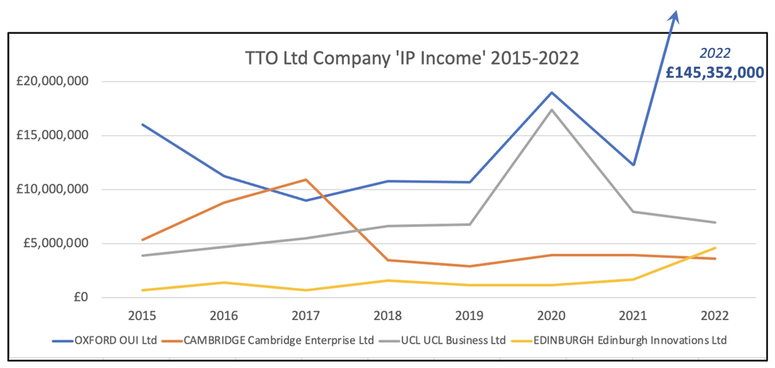

The chart below shows the technology licensing income from four leading UK university TTO companies over the last eight years, 2015 to 2022 – Oxford, UCL, Cambridge and Edinburgh. Only Oxford has exceeded £20m in a year; this being extraordinary income in 2022 of £145m largely from the Oxford AZ Covid Vaccine licence. UCL looks capable of exceeding £20m. Cambridge and Edinburgh have not reached £5m for quite a few years.

Impact over income, ‘it is not about the money’ as the tech transfer patter goes. If it was the other way around – and for some the money certainly is a major part of it – there would be questions. And perhaps there should be anyway because in this case royalty income is impact – products sold in society, services used in society, medicines taken by patients - the very things that university tech transfer is pursuing.

No UK university tech transfer office company has hit it big on licensing income, except for Oxford University Innovation in 2022 with the Oxford-AZ-Covid Vaccine licence income; in the US many university TLOs have. The conversation here these days is all about spin-outs, there’s even an ongoing government review. What about licensing ...? Investors have dominated the discourse for so long, the fine art of licensing has suffered. Should the last twenty years of investor hegemony be re-balanced?

Some people question UK universities’ relentless narrative and pursuit of spin-out companies, and relative lack of focus and success on licensing to existing companies. There are reasons: lack of indigenous industry companies as licensees; abundance of investment capital with fund managers paid to push for spin-out creation; trend for researchers ‘having a spin-out’. The concern comes from potentially losing value through inadequate licensing terms to spin-outs, and spin-outs pursuing investor exit agendas rather than anything else, royalty incomes for example.

Impact over income, ‘it is not about the money’ as the tech transfer patter goes. If it was the other way around – and for some the money certainly is a major part of it – there would be questions. And perhaps there should be anyway because in this case royalty income is impact – products sold in society, services used in society, medicines taken by patients - the very things that university tech transfer is pursuing.

No UK university tech transfer office company has hit it big on licensing income, except for Oxford University Innovation in 2022 with the Oxford-AZ-Covid Vaccine licence income; in the US many university TLOs have. The conversation here these days is all about spin-outs, there’s even an ongoing government review. What about licensing ...? Investors have dominated the discourse for so long, the fine art of licensing has suffered. Should the last twenty years of investor hegemony be re-balanced?

Some people question UK universities’ relentless narrative and pursuit of spin-out companies, and relative lack of focus and success on licensing to existing companies. There are reasons: lack of indigenous industry companies as licensees; abundance of investment capital with fund managers paid to push for spin-out creation; trend for researchers ‘having a spin-out’. The concern comes from potentially losing value through inadequate licensing terms to spin-outs, and spin-outs pursuing investor exit agendas rather than anything else, royalty incomes for example.

Ultimately UK university research outputs, protected with IPRs and licensed out on reasonable licence terms, whether to spin-outs or grown-up companies, are not behind any blockbuster products.

So, what to do? University TTOs needs to develop more expertise and put more effort into evaluating and assessing the right route-to-market; they also need to go out and develop stronger relationships with in-licensing and business development teams at leading technology companies in all sectors; and re-discover their expertise in licensing to existing companies.

Notes on the data

The data are taken from Companies House for the wholly owned subsidiary technology transfer companies at Oxford, UCL, Cambridge and Edinburgh. These four are selected for being amongst the big ones, the reliability of the data from Companies House (compared to Hebci), and clarity of breakdown of tech transfer licensing income. IP Income is a generic term for the technology licensing income shown in the Company accounts; this is separated out from the companies’ other trading income, for example consulting income where relevant.

The line items from the filed Annual Accounts at Companies House are: OUI Ltd – ‘Project Income’; Cambridge Enterprise – ‘Licence and Royalty Income’; UCLB Ltd – ‘Royalties and Licence Fees & Recovery of patent costs’; Edinburgh Innovations Ltd ‘Intellctual Property Income’.

[Imperial College is not included because whilst it has a TTO subsidiary company it has had such an uncertain ride for many years (Imperial Innovations, Touchstone, IP Group, limbo) that the data are unreliable.]

The Hebci data on IP income is highly unreliable, as discussed elsewhere. There is wide variation between the Companies House data compared to Hebci, except for UCL, where UCL Hebci and UCLB Ltd IP Income are reported as almost exactly the same – bravo! Where there is variation, it does not suggest errors, simply that the University is reporting other sources of IP income in addition to tech transfer. This further undermines the value of the Hebci data in recording university technology transfer performance. Each university will know the reasons – ‘oh, yes, that’s because of the ...’ but it is not public and collectively unobtainable.

Oxford University Innovation Ltd’s 2022 data is now published on Companies House and shows Project Income of £145m – clearly substantial, from the Covid vaccine. Oxford University accounts reports total AZ Covid vaccine royalties of £143m, net of costs being £76m. Oxford University shows Hebci IP income in 2022 of £75m. Earlier in the year, OUI has reported total income for 2022 of £31m, presumably whilst the accounting treatment of the AZ Covid licence income was being considered. The Annual accounts show other non-IP trading income of £6.1m, suggesting approximately £24m of non-AZ-Covid licence IP Income, above £20m!